Starting with ohio insurance rates, this topic delves into the key factors, comparisons across cities, tips for lowering rates, and the regulatory framework in Ohio.

Exploring the intricacies of insurance rates in Ohio sheds light on how various elements interact to determine the costs residents face.

Factors influencing Ohio insurance rates

Insurance rates in Ohio are influenced by a variety of factors that help determine the premiums individuals pay for coverage. Understanding these factors can help individuals make informed decisions when selecting insurance plans.

Demographic factors, Ohio insurance rates

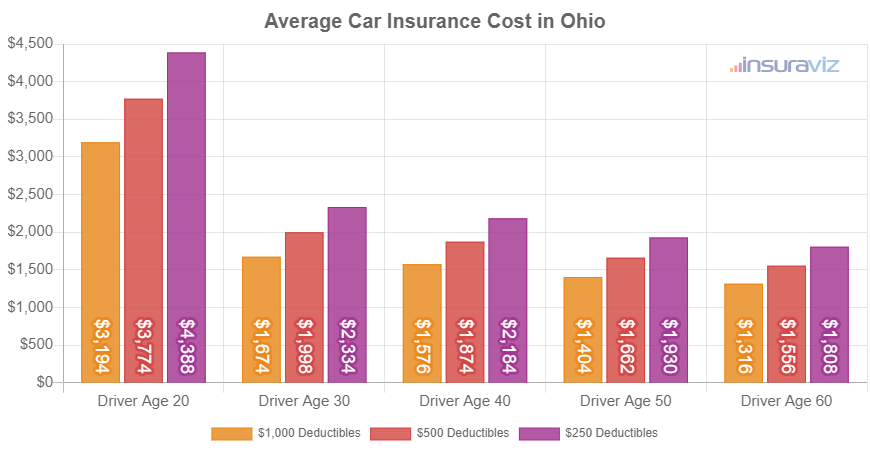

Demographic factors such as age, gender, and location play a significant role in determining insurance rates in Ohio. Younger drivers, especially teenagers, tend to face higher insurance premiums due to their lack of driving experience and higher likelihood of accidents. Gender can also impact rates, with statistics showing that young male drivers typically face higher premiums compared to their female counterparts. Additionally, the location where a driver resides can affect insurance rates, as urban areas tend to have higher rates of accidents and theft, leading to increased premiums.

Type of coverage and deductible levels

The type of coverage selected and the deductible levels chosen can also influence insurance premiums in Ohio. Comprehensive coverage that includes protection against a wide range of risks will generally result in higher premiums compared to basic liability coverage. Additionally, opting for a lower deductible means that the insurance company will have to pay out more in the event of a claim, leading to higher premiums.

Driving record and credit score

A driver’s driving record and credit score are crucial factors that impact insurance rates in Ohio. A clean driving record with no accidents or traffic violations can result in lower premiums, as it indicates a lower risk of future claims. On the other hand, a history of accidents or traffic infractions can lead to higher insurance rates. Furthermore, a good credit score is often associated with responsible financial behavior and can result in lower insurance premiums, while a poor credit score may lead to higher rates.

Comparison of insurance rates in Ohio

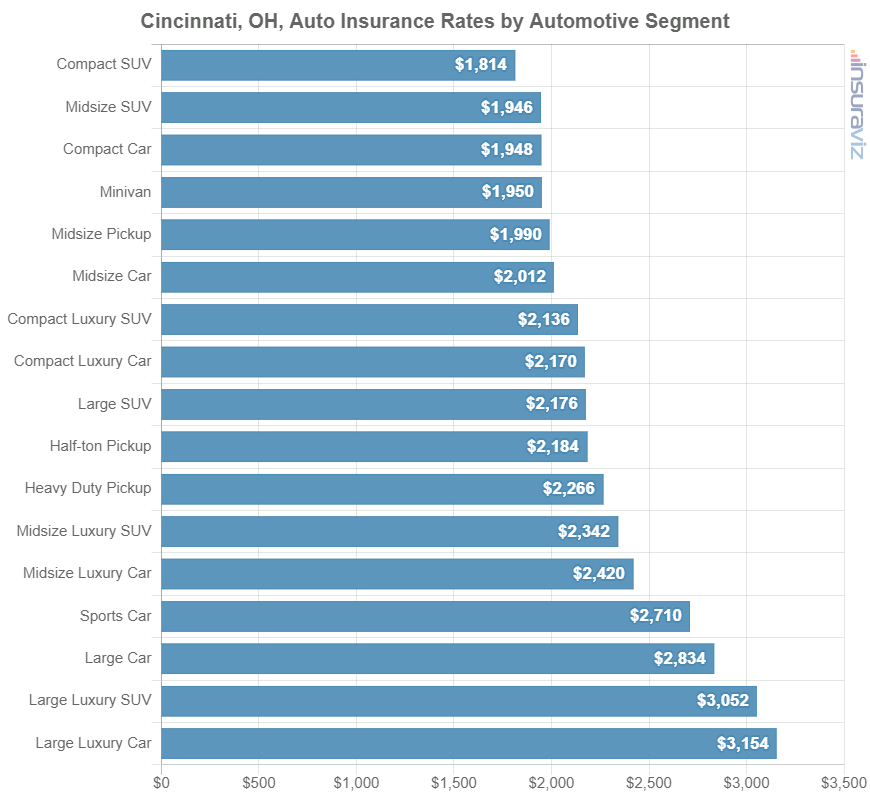

Ohio insurance rates can vary significantly across different cities in the state. Urban areas tend to have higher insurance costs compared to rural regions due to factors such as higher population density, increased traffic congestion, and greater likelihood of accidents or theft. On the other hand, rural areas may have lower insurance rates due to less traffic, lower crime rates, and fewer accidents.

Average Insurance Rates Across Different Cities

- Columbus: The average annual insurance rate in Columbus is around $1,100.

- Cleveland: Insurance rates in Cleveland average around $1,300 per year.

- Cincinnati: Residents of Cincinnati pay an average of $1,200 annually for insurance.

- Dayton: The average insurance rate in Dayton is approximately $1,000 per year.

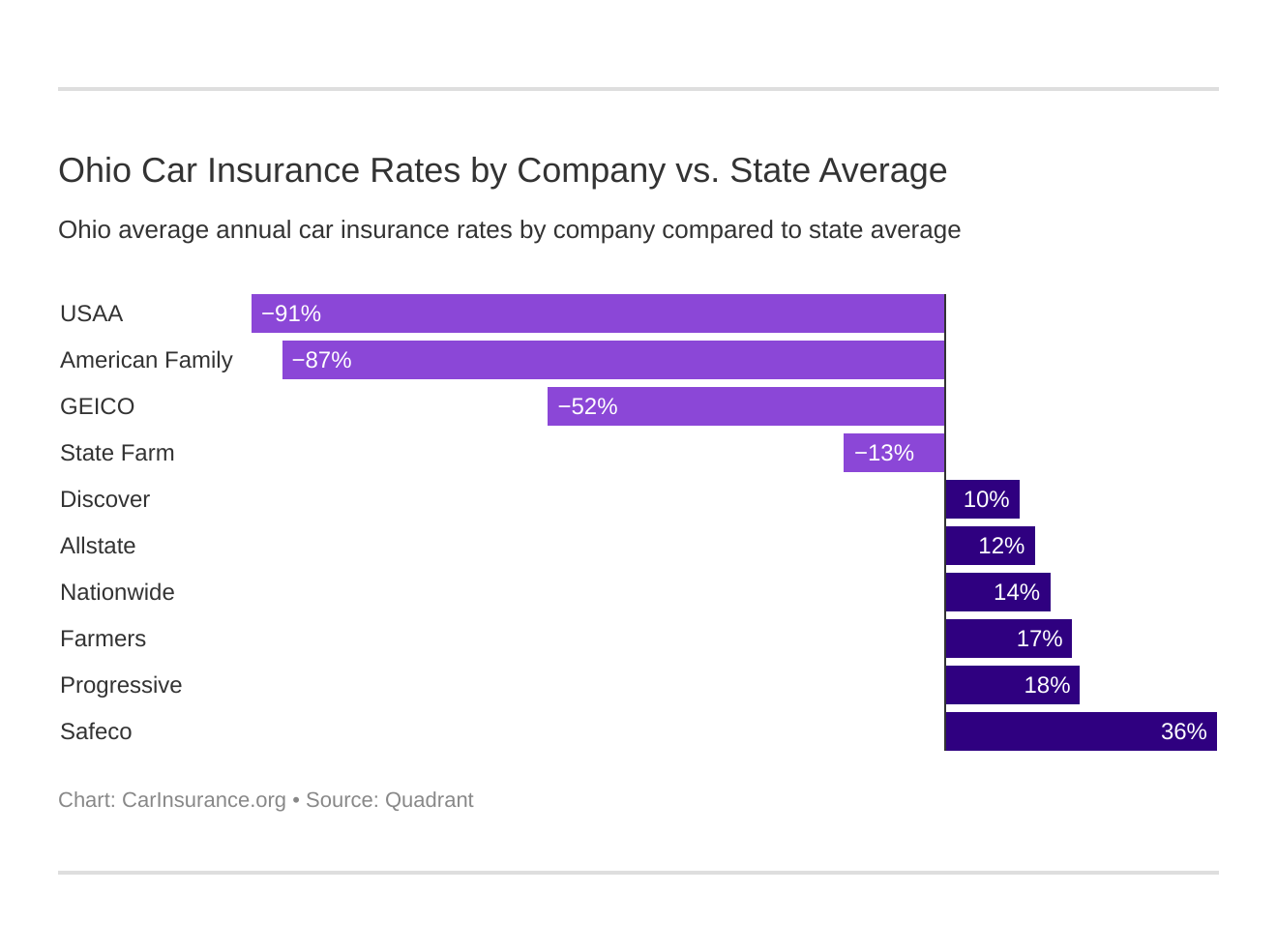

Variation in Insurance Providers

- State Farm: Known for competitive rates and good customer service, State Farm offers affordable insurance options for Ohio residents.

- Allstate: Allstate may have slightly higher rates but provides comprehensive coverage options and excellent customer support.

- Progressive: Progressive is popular for offering customizable plans and discounts, making it a preferred choice for many Ohio drivers.

Trends in Insurance Rate Fluctuations

Insurance rates in Ohio have shown a general upward trend over the years due to factors such as increased costs of vehicle repairs, medical expenses, and legal fees. Additionally, fluctuations in the economy, changes in driving behaviors, and advancements in technology can also impact insurance rates. It is essential for consumers to regularly review their insurance policies and compare rates from different providers to ensure they are getting the best coverage at the most competitive price.

Tips for lowering insurance rates in Ohio

Insurance rates in Ohio can be expensive, but there are ways to lower your premiums and save money. By implementing certain strategies and making wise choices, you can reduce the cost of your insurance coverage and still maintain adequate protection for yourself and your assets.

Impact of bundling policies

Bundling your insurance policies, such as combining your auto and home insurance with the same provider, can lead to significant discounts on your premiums. Insurance companies often offer discounts for customers who purchase multiple policies from them, so consider bundling to lower your overall insurance costs.

Improving driving habits

Another effective way to lower insurance rates in Ohio is by improving your driving habits. Maintaining a clean driving record free of accidents and traffic violations can qualify you for lower rates. Consider taking defensive driving courses to enhance your skills and demonstrate your commitment to safe driving.

Maintaining a good credit score

Your credit score can also impact your insurance rates in Ohio. Insurance companies often use credit-based insurance scores to determine premiums, with higher scores typically leading to lower rates. By maintaining a good credit score through responsible financial behavior, such as paying bills on time and managing debt wisely, you can potentially lower your insurance costs.

Regulatory framework for insurance rates in Ohio

Ohio’s insurance industry is regulated by the Ohio Department of Insurance (ODI), which oversees the setting of insurance rates in the state. The ODI ensures that insurance companies comply with state laws and regulations to protect consumers and maintain a fair insurance market.

Role of Regulatory Bodies

The ODI plays a crucial role in overseeing insurance rates in Ohio by reviewing rate filings, investigating complaints, and monitoring insurance companies’ practices. It ensures that insurance premiums are set fairly and competitively to prevent discrimination and ensure affordability for consumers.

- The ODI reviews rate filings submitted by insurance companies to ensure they comply with state laws and regulations.

- The department investigates consumer complaints related to insurance rates to address any issues of unfair pricing practices.

- Regulations set by the ODI help create a competitive insurance market in Ohio, benefiting consumers by offering a variety of insurance options at competitive rates.

Recent Changes in Regulations

In recent years, the ODI has implemented changes to insurance regulations in Ohio to enhance consumer protection and promote transparency in insurance pricing. These changes aim to ensure that insurance rates are fair and reasonable for Ohio residents.

- Recent regulations require insurance companies to disclose more information about their rate-setting practices to the ODI and consumers, promoting transparency in insurance pricing.

- The ODI has also introduced stricter guidelines for reviewing rate filings to ensure that insurance premiums are based on accurate data and risk assessments.

Consumer Protection Measures

Ohio has implemented various consumer protection measures to safeguard residents from unfair insurance pricing practices and ensure access to affordable coverage. These measures help protect consumers’ rights and promote a competitive insurance market in the state.

- The ODI provides resources and information to help consumers understand their insurance options and rights when it comes to insurance rates.

- Ohio law prohibits insurance companies from unfairly discriminating against policyholders based on factors such as age, gender, or marital status, ensuring fair pricing for all consumers.

- Consumer advocacy groups work with the ODI to address consumer complaints and advocate for policies that benefit Ohio insurance consumers.

Closing Summary: Ohio Insurance Rates

In conclusion, understanding Ohio insurance rates involves a comprehensive analysis of influencing factors, comparisons, strategies for savings, and the regulatory environment.

User Queries

How do age, gender, and location impact insurance rates in Ohio?

Age, gender, and location play a significant role in determining insurance rates in Ohio. Younger drivers, males, and urban residents generally face higher premiums.

What impact does bundling policies have on insurance costs in Ohio?

Bundling policies, such as combining home and auto insurance, can often lead to discounts and lower overall insurance costs in Ohio.

How can maintaining a good credit score help in lowering insurance rates in Ohio?

A good credit score demonstrates financial responsibility and can result in lower insurance rates as insurers view you as a lower risk.

Who oversees insurance rates in Ohio?

Insurance rates in Ohio are regulated by the Ohio Department of Insurance, ensuring fair practices and consumer protection.

Are there any recent changes in insurance regulations impacting rates in Ohio?

Recent changes in insurance regulations in Ohio have aimed at promoting transparency, fairness, and accessibility in insurance pricing.