Starting with John Hancock Travel Insurance Cancel For Any Reason, this insurance option provides flexibility and peace of mind for travelers. Understanding the coverage and process involved is essential for making informed decisions.

This type of coverage allows travelers to cancel their trip for any reason, providing a safety net in unpredictable situations. John Hancock Travel Insurance offers specific coverage for such cancellations, with benefits and limitations to consider.

Overview of John Hancock Travel Insurance Cancel for Any Reason

When it comes to travel insurance, ‘cancel for any reason’ coverage provides the policyholder with the flexibility to cancel their trip for reasons that may not be covered under standard cancellation policies.

Coverage Offered by John Hancock Travel Insurance

- John Hancock Travel Insurance offers ‘cancel for any reason’ coverage as an optional upgrade to their standard policies.

- This coverage allows travelers to cancel their trip for any reason up to a certain percentage of the trip cost, typically around 75% to 90%.

- With this coverage, travelers can receive reimbursement for a portion of their prepaid, non-refundable trip costs.

Benefits and Limitations of ‘Cancel for Any Reason’ Coverage

- Benefits:

- Flexibility: Travelers have the freedom to cancel their trip for any reason, whether it’s personal, work-related, or simply a change of mind.

- Peace of Mind: Knowing that they can recoup a significant portion of their trip costs provides peace of mind in uncertain situations.

- Coverage Gaps: Helps fill in the gaps where standard cancellation policies may not cover certain reasons for cancellation.

- Limitations:

- Cost: ‘Cancel for any reason’ coverage typically comes at an additional cost, making it more expensive than standard policies.

- Percentage Limit: The reimbursement amount is usually capped at a certain percentage of the trip cost, so travelers may not recoup the full amount.

- Time Constraints: There is often a deadline by which travelers must cancel their trip to be eligible for this coverage, usually within a specific timeframe before the departure date.

Eligibility and Requirements

To be eligible for purchasing ‘cancel for any reason’ coverage with John Hancock Travel Insurance, travelers must meet certain criteria and requirements. This type of coverage provides added flexibility and peace of mind for those who may need to cancel their trip for reasons not covered by standard travel insurance policies.

Eligibility Criteria

- Travelers must purchase the ‘cancel for any reason’ coverage within a specified time frame, usually within a certain number of days from the initial trip booking.

- The coverage may only be available for certain types of trips or destinations, so travelers should check the policy details to ensure their trip qualifies.

- Some age restrictions or health conditions may apply, so travelers should review the eligibility requirements carefully.

Verification Process

- Travelers can verify their eligibility for ‘cancel for any reason’ coverage by reading the policy documents provided by John Hancock Travel Insurance.

- It is important to understand the terms and conditions of the coverage, including any exclusions or limitations that may apply.

- If travelers have any questions about their eligibility or specific requirements, they can contact the insurance provider directly for clarification.

Process of Cancelling for Any Reason

When it comes to canceling a trip for any reason with John Hancock Travel Insurance, travelers must follow a specific process to ensure their cancellation is processed correctly and efficiently.

Initiating the Cancellation Process

- Contact John Hancock Travel Insurance as soon as possible to inform them of your decision to cancel your trip for any reason.

- Provide your policy details and reason for cancellation to the customer service representative.

- Follow any additional instructions provided by the representative to complete the cancellation process.

Documentation and Proof Required

- Depending on the reason for cancellation, you may be required to provide supporting documentation such as a doctor’s note, death certificate, or proof of a covered event.

- Make sure to gather all necessary documentation before contacting John Hancock Travel Insurance to expedite the cancellation process.

- Ensure that all documentation provided is accurate and meets the requirements Artikeld in your policy.

Claiming Process and Documentation

When it comes to filing a claim for a canceled trip under ‘cancel for any reason’ coverage with John Hancock Travel Insurance, there are specific procedures and documentation requirements that travelers need to be aware of in order to successfully process their claim.

Submitting a Claim

- Notify John Hancock Travel Insurance as soon as possible about the cancellation of your trip.

- Fill out the necessary claim forms provided by the insurance company.

- Provide all relevant documentation to support your claim, such as booking confirmations, receipts, and any other proof of expenses.

Required Documentation

- Proof of trip cancellation, such as a letter from the travel provider stating the reason for cancellation.

- Documentation of any non-refundable expenses incurred due to the cancellation.

- Copies of all receipts and invoices related to the canceled trip.

- Any other supporting documents that may be requested by the insurance company.

Timeline and Processing Requirements

- Claims must typically be filed within a certain timeframe after the cancellation of the trip, as specified in the policy.

- Once all required documentation is submitted, the insurance company will review the claim and make a decision on the eligibility for reimbursement.

- It is important to follow up with the insurance company and provide any additional information or documentation they may require for processing the claim.

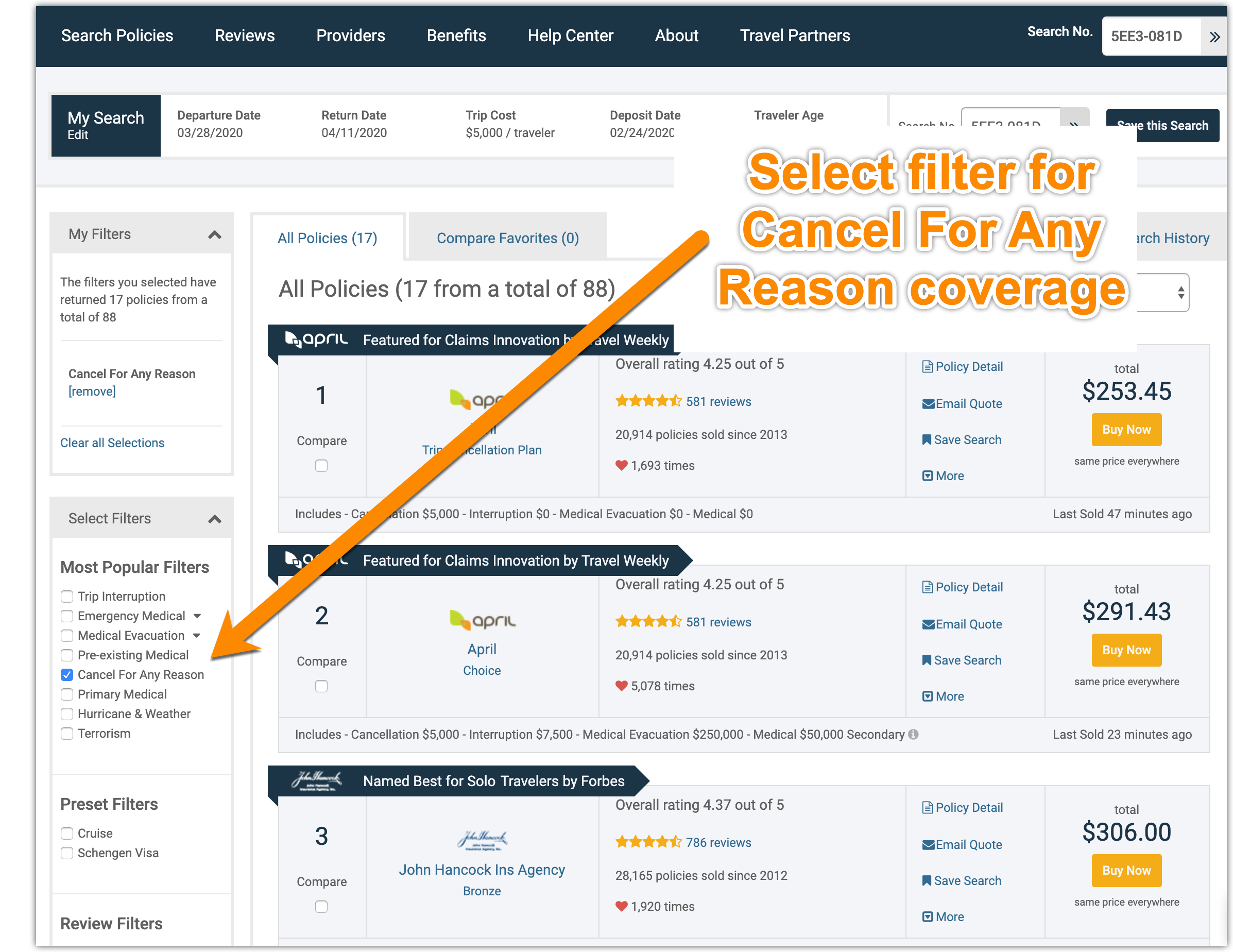

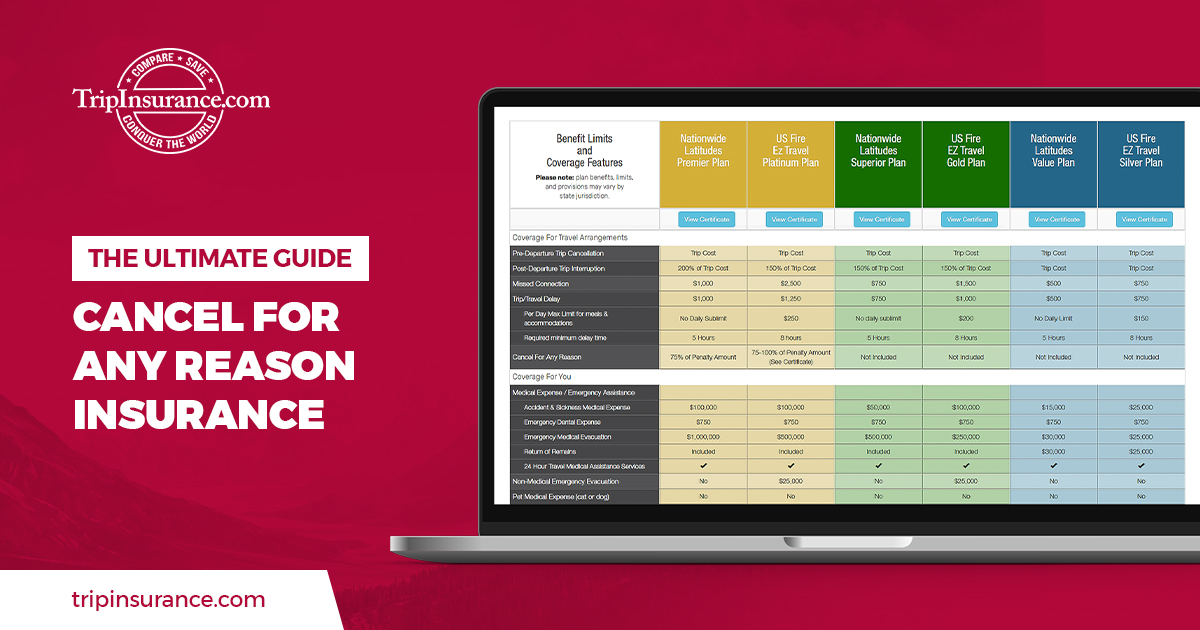

Comparisons with Other Travel Insurance Providers

When comparing John Hancock Travel Insurance’s ‘cancel for any reason’ coverage with similar offerings from other providers, it is essential to consider the unique features and advantages that set them apart. Understanding the differences in coverage, cost, and terms can help travelers make an informed decision when selecting the right insurance provider for their needs.

Coverage and Benefits

- John Hancock Travel Insurance offers comprehensive ‘cancel for any reason’ coverage, allowing travelers to cancel their trip for any reason not covered by traditional policies.

- Some other providers may offer similar coverage, but with limitations on the reasons for cancellation or lower reimbursement rates.

- John Hancock’s coverage may include reimbursement for a higher percentage of non-refundable trip costs compared to other providers.

Cost and Premiums

- While John Hancock Travel Insurance’s ‘cancel for any reason’ coverage may come at a higher premium, the added flexibility and peace of mind it offers can be worth the investment for some travelers.

- Some other providers may offer lower premiums for similar coverage, but travelers should carefully review the terms and conditions to ensure they meet their specific needs.

- Comparing the cost of coverage and the level of protection provided by different providers can help travelers find the best value for their money.

Terms and Conditions, John hancock travel insurance cancel for any reason

- It is essential for travelers to review the terms and conditions of ‘cancel for any reason’ coverage from different providers to understand any exclusions or limitations that may apply.

- John Hancock Travel Insurance may have specific requirements or documentation needed to process a cancellation claim, so travelers should be aware of these before purchasing a policy.

- Comparing the terms and conditions of different providers can help travelers choose the policy that best aligns with their travel plans and preferences.

Real-life Scenarios and Examples: John Hancock Travel Insurance Cancel For Any Reason

In real-life situations, travelers may encounter unexpected events or circumstances that require them to cancel their trip for any reason. Here are some examples of scenarios where travelers might need to cancel their trip and how John Hancock Travel Insurance’s coverage would apply:

Scenario 1: Family Emergency

- A traveler’s parent falls ill and requires immediate medical attention.

- With John Hancock Travel Insurance’s ‘cancel for any reason’ coverage, the traveler can cancel their trip and receive reimbursement for non-refundable expenses.

Scenario 2: Work Commitments

- An unexpected work obligation arises, requiring the traveler to cancel their vacation.

- John Hancock Travel Insurance’s coverage allows the traveler to cancel for any reason, ensuring they are financially protected against unforeseen work-related issues.

Scenario 3: Natural Disaster

- A hurricane or other natural disaster threatens the destination, making travel unsafe.

- By utilizing John Hancock Travel Insurance’s ‘cancel for any reason’ benefit, the traveler can cancel their trip and receive compensation for pre-paid expenses.

Final Wrap-Up

In conclusion, John Hancock Travel Insurance’s Cancel For Any Reason option offers a valuable safety net for travelers. By understanding the eligibility criteria, process of cancellation, and claiming procedures, travelers can make the most of this flexible coverage.

FAQ Corner

Is there a limit to the reasons I can cancel my trip for with John Hancock Travel Insurance?

Yes, this coverage allows you to cancel for any reason, providing flexibility and peace of mind.

What documentation is required when canceling a trip for any reason?

Travelers may need to submit proof of cancellation reasons, such as medical certificates or trip details.

How does John Hancock’s Cancel For Any Reason coverage compare to other providers?

John Hancock’s coverage may offer unique advantages or features compared to similar offerings from other providers. It’s important to compare coverage, cost, and terms.