Humana Supplemental Medicare Insurance offers a vital safety net for those seeking additional coverage beyond traditional Medicare plans. Delve into the world of benefits, coverage options, and enrollment processes with us.

Introduction to Humana Supplemental Medicare Insurance

Humana Supplemental Medicare Insurance provides additional coverage beyond what Original Medicare offers, helping beneficiaries manage out-of-pocket expenses and access a wider range of healthcare services. This supplemental insurance is designed to fill the gaps in coverage left by Medicare Parts A and B, offering peace of mind and financial protection to those enrolled.

Benefits of Humana Supplemental Medicare Insurance

- Enhanced Coverage: Humana Supplemental Medicare Insurance provides coverage for services not covered by Original Medicare, such as dental, vision, and prescription drugs, ensuring comprehensive healthcare protection.

- Cost Savings: By reducing out-of-pocket expenses like deductibles, copayments, and coinsurance, Humana Supplemental Medicare Insurance helps beneficiaries save on healthcare costs, making quality care more affordable.

- Provider Network: With access to a large network of healthcare providers, including specialists and hospitals, beneficiaries can choose the providers that best meet their healthcare needs without worrying about network restrictions.

Coverage Options under Humana Supplemental Medicare Insurance

- Medicare Advantage Plans: These plans, also known as Medicare Part C, combine Part A, Part B, and often Part D (prescription drug coverage) into one comprehensive plan offered by private insurance companies like Humana.

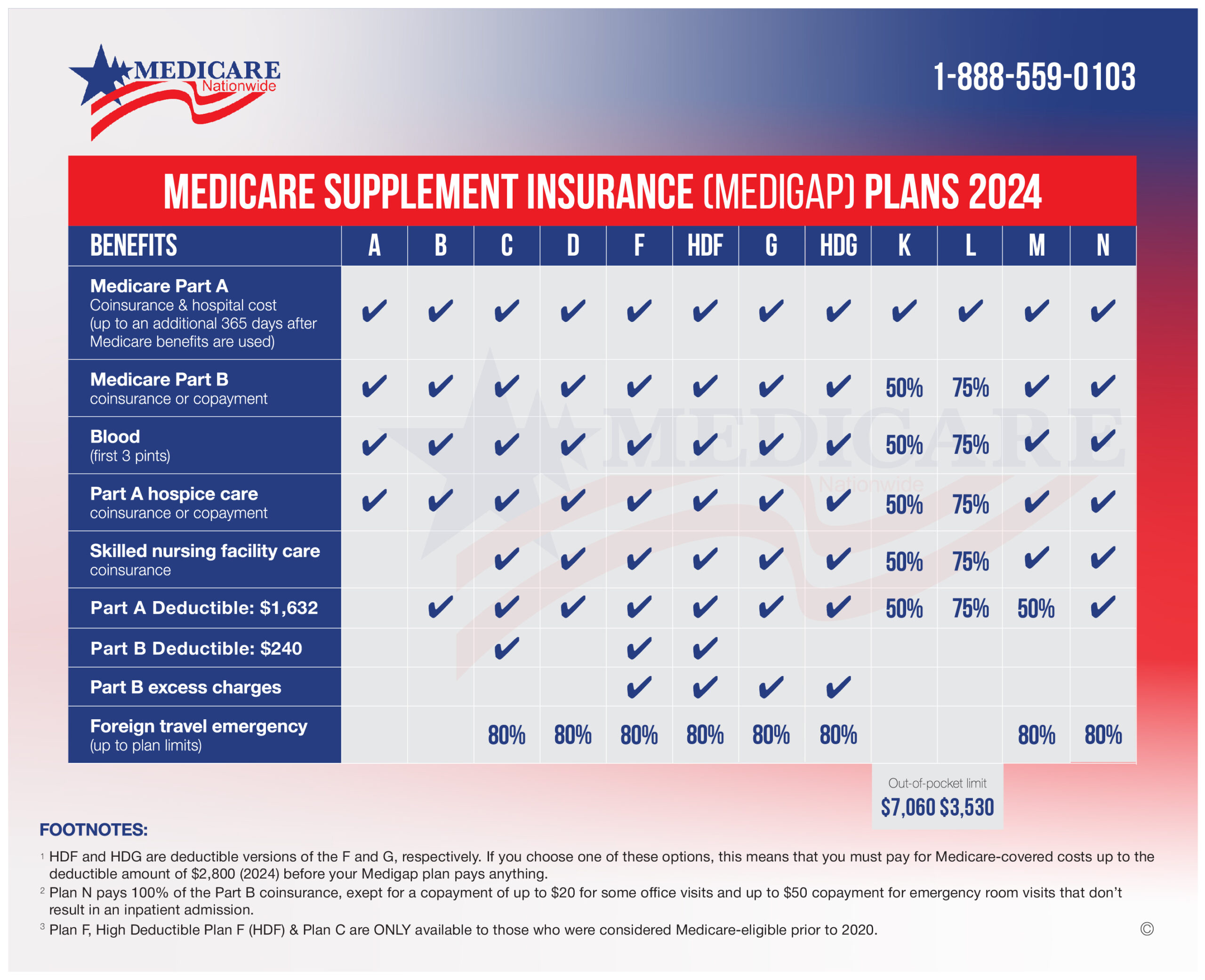

- Medicare Supplement Insurance (Medigap): Medigap policies are designed to supplement Original Medicare coverage by paying for costs not covered by Medicare, such as copayments, coinsurance, and deductibles.

- Stand-Alone Prescription Drug Plans (Part D): These plans provide coverage for prescription medications and can be added to Original Medicare or a Medicare Supplement Insurance plan to ensure comprehensive drug coverage.

Coverage Details

Humana Supplemental Medicare Insurance provides coverage for a wide range of medical services that are not fully covered by traditional Medicare plans. This supplemental insurance helps fill the gaps in coverage and offers additional benefits to ensure comprehensive healthcare protection for beneficiaries.

Specific Medical Services Covered

- Prescription drugs

- Vision care, including eye exams and eyeglasses

- Dental care, such as routine cleanings and procedures

- Hearing aids and related services

- Mental health services, including therapy and counseling

- Home health care and skilled nursing facility care

Beneficial Situations

- When needing regular prescription medications not covered by traditional Medicare

- For individuals with vision or dental care needs that are not included in original Medicare

- When requiring mental health services or therapy sessions

- For those who may need assistance with hearing aids or related services

- When planning for long-term care or home health services

Comparison with Traditional Medicare, Humana supplemental medicare insurance

Humana Supplemental Medicare Insurance offers additional coverage beyond what traditional Medicare plans provide. While original Medicare covers hospital and medical services, Humana’s supplemental insurance extends coverage to areas like prescription drugs, vision care, dental care, and more. This extra coverage can be particularly beneficial for individuals with specific healthcare needs that are not fully addressed by traditional Medicare alone.

Cost and Pricing: Humana Supplemental Medicare Insurance

When it comes to Humana Supplemental Medicare Insurance, understanding the cost and pricing structure is crucial for making informed decisions about your healthcare coverage. Let’s explore how the cost of Humana Supplemental Medicare Insurance is determined, any additional fees or charges associated with the plan, and tips on managing these costs effectively.

Cost Determination

The cost of Humana Supplemental Medicare Insurance is typically determined based on several factors, including your age, location, the type of plan you choose, and any additional coverage options you select. Premiums can vary based on these variables, so it’s important to evaluate your individual needs and budget when selecting a plan.

Additional Fees and Charges

In addition to the monthly premium for your Humana Supplemental Medicare Insurance plan, there may be other fees or charges to consider. These could include deductibles, copayments, coinsurance, and out-of-pocket maximums. It’s essential to review the plan details carefully to understand all potential costs associated with your coverage.

Tips for Managing Costs

– Compare plans: Take the time to compare different Humana Supplemental Medicare Insurance plans to find one that offers the coverage you need at a price you can afford.

– Utilize preventive services: By staying proactive about your health and utilizing preventive services covered by your plan, you may be able to avoid more significant healthcare costs down the line.

– Review your coverage annually: Your healthcare needs may change over time, so it’s essential to review your coverage annually to ensure you have the right plan for your current situation.

– Take advantage of discounts: Some plans may offer discounts for activities like enrolling in automatic payments or completing a health risk assessment. Be sure to take advantage of these opportunities to save on costs.

Enrollment Process

When it comes to enrolling in Humana Supplemental Medicare Insurance, the process is relatively straightforward. Here are the steps to follow, eligibility requirements, and deadlines to keep in mind:

Steps to Enroll

- Contact Humana: Reach out to Humana either online, over the phone, or in person to start the enrollment process.

- Provide Information: You will need to provide personal details, such as your name, address, Medicare number, and any other required information.

- Select a Plan: Choose the Humana Supplemental Medicare Insurance plan that best fits your needs and budget.

- Submit Application: Fill out the enrollment application accurately and submit it to Humana for processing.

- Review and Confirm: Review all the details provided in your application before confirming your enrollment in the plan.

Eligibility Requirements

- Must be enrolled in Medicare Part A and Part B

- Reside in the service area of the Humana Supplemental Medicare Insurance plan

- Meet any additional eligibility criteria set by Humana

Deadlines and Timelines

- Initial Enrollment Period: Typically starts three months before you turn 65 and ends three months after.

- Annual Enrollment Period: Occurs every year from October 15th to December 7th.

- Special Enrollment Period: Available in certain circumstances, such as moving to a new area or losing other coverage.

End of Discussion

In conclusion, Humana Supplemental Medicare Insurance provides a valuable layer of protection and peace of mind for your healthcare needs. Explore the possibilities and secure your future health today.

Questions Often Asked

How is the cost of Humana Supplemental Medicare Insurance determined?

The cost of Humana Supplemental Medicare Insurance is based on various factors such as age, location, and the specific plan selected.

What are the eligibility requirements for enrolling in Humana Supplemental Medicare Insurance?

To enroll in Humana Supplemental Medicare Insurance, individuals must already be enrolled in Medicare Part A and Part B.

Are there any additional fees or charges associated with Humana Supplemental Medicare Insurance?

While the cost of the plan itself is determined by factors mentioned earlier, there may be additional charges for certain services or options within the plan.